Let’s talk about that awkward moment at the hospital billing counter. You’ve got the discharge papers, your family member is finally feeling better, and you hand over your health insurance card with a sense of “thank god I have this.” Then, twenty minutes later, the insurance guy comes back with a long face and says, “Sir, this won’t be covered. Waiting period ka lafda hai (it’s a waiting period issue).”

Suddenly, your ₹2 lakh savings meant for a house down payment or a kid’s fee are gone.

YOU CAN ALSO READ:

How BNPL (Buy Now Pay Later) traps middle-class usersThe worst part? You actually paid for the insurance. You didn’t miss a premium. You just didn’t understand the “time-lock” on your policy. If you find health insurance jargon confusing, trust me, you are not alone. It’s designed to be boring so you don’t read the fine print. But waiting periods are the one thing you mustunderstand before you sign that dotted line.

The “Rahul” Story: A Costly Misunderstanding

Take my friend Rahul. He bought a top-tier health insurance plan last year in January. He was proud of himself finally being a responsible adult. In August, he felt a sharp pain and was diagnosed with kidney stones. No big deal, right? He has insurance.

He went in for the surgery, thinking the ₹1.5 lakh bill was taken care of. But the claim was rejected. Why? Because most policies have a 2-year waiting period for “specific ailments” like kidney stones, even if you didn’t have them when you bought the policy.

The Lesson: Insurance isn’t like a credit card that you can swipe and use for everything on day one. It’s more like a “loyalty program” where certain benefits only unlock after you’ve stayed with the company for a specific number of years.

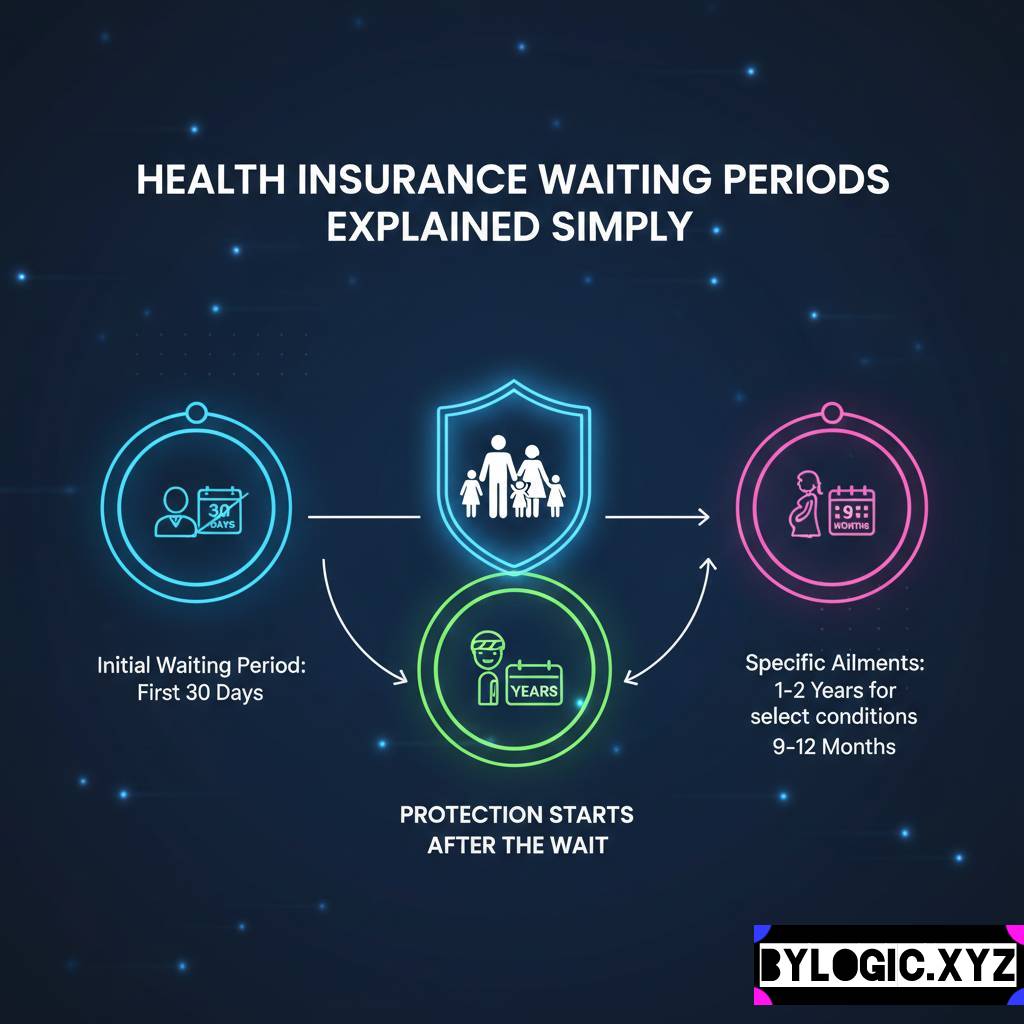

The Big Three: Breaking Down the Wait

To keep it simple, think of waiting periods in three distinct buckets. If you get these three right, you’re already ahead of 90% of policyholders.

1. The Initial “Cooling-Off” (30 Days)

This is the most basic one. For the first 30 days of your policy, you are essentially “uninsured” for regular illnesses. If you catch a viral fever or get hospitalized for food poisoning on day 15, the company won’t pay.

- The Exception: Accidents. If someone hits your bike on day 2, the insurance will cover the emergency.

- Why? To prevent people from buying a policy only when they feel a fever coming on today.

2. Specific Ailments (2 Years)

This is where Rahul got stuck. There is a list of “slow-growing” conditions that insurers won’t cover for the first two years. We’re talking about things like Cataracts, Hernia, Piles, Joint Replacements, and yes, Kidney Stones.

- The Opinion: Personally, I think this is a bit harsh, but the logic is that these conditions don’t happen overnight. Insurers want to make sure you aren’t joining the “club” just to get a planned surgery done and then leaving.

3. Pre-Existing Diseases (PED) (3 Years)

If you already have Diabetes, Hypertension (High BP), or Asthma when you buy the policy, these are PEDs. Earlier, companies made you wait 4 years. But thanks to the 2024-2026 IRDAI updates, this has been capped at 3 years.

- Crucial Note: If you hide these diseases to avoid the wait, your claim will be rejected later for “non-disclosure.” Don’t do it. It’s better to wait 3 years for a valid claim than to pay premiums for 10 years only to have a rejection when it matters most.

Comparison: Standard Plan vs. The “Jugaad” Plan (Waiting Period Waiver)

Nowadays, you can actually “buy” your way out of these waiting periods using riders or specific plans. Here is how they usually stack up:

| Feature | Standard Health Plan | “Wait-Reduction” Premium Plan |

| Initial Wait | 30 Days | 30 Days (Usually same) |

| PED Waiting Period | 3 Years (Standard) | 1 Year or even 0 (with add-ons) |

| Specific Ailments | 2 Years | 1 Year or 0 |

| Premium Cost | Base Price | 20% to 40% Higher |

| Best For | Young, healthy folks | People with BP/Diabetes or those over 45 |

My Take: If you are over 45 or have a history of lifestyle diseases, pay the extra premium for a “PED Waiver” or “Wait Reduction” rider. It’s better to pay ₹5,000 extra now than to face a ₹5 lakh rejection three years later because your “3-year wait” wasn’t over. Please consult your financial advisor before taking any financial decision regarding high-premium riders.

YOU CAN ALSO READ:

EMI calculators vs bank EMIs: hidden differencesHow to: Minimize Your Waiting Period Stress

If you are looking to buy a policy or have one already, here is the “cheat sheet” to handle this:

- Check for “Day 1” Coverage (Group Insurance): If your employer provides insurance, usually there is zero waiting period. Use this for your PEDs while you “wait out” the period in your personal policy.

- Use the Portability Power: If you’ve already served 2 years in Plan A and you move to Plan B (Porting), your “credit” moves with you. You don’t start from zero again. This is a huge win for consumers.

- Disclose Everything (No, Really): Even if it’s “mild” sugar, mention it. Under the new 5-year Moratorium Rule, after 5 years of continuous renewals, a company cannot reject your claim for non-disclosure (unless they prove intentional fraud). But let’s not get to that stage. Be honest.

- Look for “Waiver Riders”: Ask your agent specifically: “Can I reduce the 3-year PED wait to 1 year by paying more?” Many new-age insurers allow this now.

Myth vs. Reality: The Stuff People Get Wrong

Myth: “If I am hospitalized for a heart attack, the 2-year specific ailment wait will apply.”

Reality: No. Heart attacks, strokes, or sudden infections like Malaria/Dengue are “acute” conditions. As long as the initial 30 days are over and it wasn’t a pre-existing condition, you are covered. The 2-year wait is only for specific planned surgeries listed in the policy.

Myth: “I can buy a policy for my pregnant wife and get the delivery covered next month.”

Reality: Arrey, I wish. Maternity waiting periods are the longest ranging from 9 months to 3 years. You have to plan the insurance before you even plan the baby.

The “Moratorium Period” – Your Secret Shield

There’s a concept most people miss: The 5-year Moratorium. Basically, if you keep a policy active for 5 years without a break, the insurance company loses its right to question you on “non-disclosure” of old diseases (except in cases of clear, massive fraud).

It’s the industry’s way of saying, “Okay, you’ve been a loyal customer for 5 years, we will stop nitpicking your medical history now.” This is why “policy hopping” every year is a bad idea. Stay with a good brand and let your waiting periods expire.

Final Thoughts

Look, the hospital is the last place you want to be debating clauses and definitions. Waiting periods are a necessary evil that insurers use to keep premiums low for everyone otherwise, people would only buy insurance on the way to the operation theater.

The trick is to start early. If you buy a policy at 25, by the time you actually need it at 35 or 45, all your waiting periods PED, specific ailments, maternity will be long gone. You’ll have a “clean” policy that works like a charm.

Don’t wait for a “health scare” to buy health insurance. By then, the waiting period will be your biggest enemy.

YOU CAN ALSO READ:

SIP vs lumpsum investment during market highsDisclaimer: Insurance is a subject matter of solicitation. Please consult your financial advisor before taking any financial decision.

Explore more categories:

https://bylogic.xyz/category/investing-and-wealth-building/

https://bylogic.xyz/category/loans-and-credit/